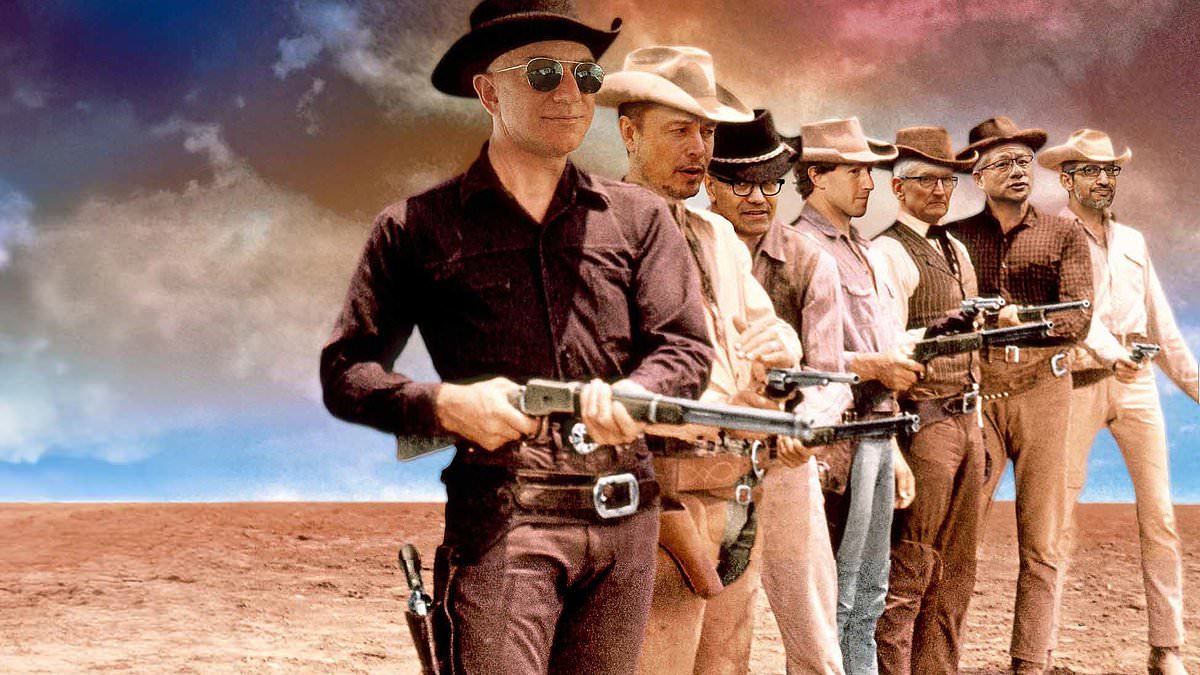

The Magnificent Seven – the titans of technology in the US – have established their dominance on stock markets for the past couple of years, resulting in impressive returns. The once unassuming leaders of these companies have transformed into billionaires, enjoying significant political leverage as acquaintances of President Trump.

The trajectory of the US stock market has largely hinged on these seven giants: Alphabet, the parent company of Google; Amazon; Apple; Meta, which oversees platforms like Instagram, Facebook, and WhatsApp; Microsoft; semiconductor powerhouse Nvidia; and electric vehicle innovator Tesla.

There’s some debate over who first termed these tech giants the Magnificent Seven, drawing inspiration from the iconic 1960s western film. Both Bank of America and Goldman Sachs have laid claim to this catchy moniker.

However, a more pressing debate surrounds the question of whether to continue investing in these behemoths, either directly or indirectly through investment accounts and pension funds.

Here’s everything you need to know about them now.

**Alphabet**

**EXPERT VERDICT: BUY**

Established in 1998 by PhD candidates Sergey Brin and Larry Page, Alphabet, initially known as Google, has evolved into a colossal $2.5 trillion entity focused on digital advertising.

The company has diversified into cloud computing and recently made strides in artificial intelligence (AI) with its Gemini system. The unveiling of Willow, a groundbreaking chip for quantum computing, is another testament to its forward-thinking approach.

Under the leadership of Sundar Pichai, a fitness enthusiast and vegetarian who took the helm in 2019, Alphabet has momentarily stumbled. Despite ambitious moves, including a hefty $75 billion investment in AI that surpassed expectations, Alphabet’s shares took a hit following a less-than-stellar fourth quarter report. Nonetheless, analysts express optimism, continually rating Alphabet shares a ‘buy’.

**Amazon**

**EXPERT VERDICT: BUY**

When Jeff Bezos, a graduate of Princeton University, launched Amazon in 1994 from a garage as a modest bookseller, he could hardly have envisioned its trajectory to becoming the largest online retailer today, valued at around $2.5 trillion.

A staple of profitability for Amazon is its Amazon Web Services (AWS) – the leading provider of cloud computing solutions around the globe, claiming over 30% market share. The recent investment in AI-focused Anthropic was a strategic move to keep pace with Microsoft’s acquisition of OpenAI, creator of the renowned ChatGPT.

While Bezos stepped down as CEO in July 2021, having handed over the reins to Andy Jassy, he remains the chairman with a 9% equity stake in the company. The returns for early investors are remarkable; a £1,000 investment during its public offering in 1997 would today yield an astounding £2,663,000. Currently, shares are at $229, with experts forecasting further growth, highlighted by Swiss bank UBS recently raising its target price to $275.

**Apple**

**EXPERT VERDICT: BUY**

Founded in a Los Altos garage in 1976 by tech pioneers Steve Jobs and Steve Wozniak, Apple has undergone an incredible transformation, now worth $3.6 trillion and often regarded not just as a tech company but as a luxury goods brand.

Despite experiencing weak sales in China, Apple’s global revenue for the last quarter reached $124.3 billion—surpassing expectations. Those who invested £1,000 when the company first became publicly traded in 1980 would now hold shares worth approximately £2.5 million. Over the past year, shares have appreciated by 20% to reach $228, prompting analysts to endorse them as a ‘buy’.

Much of this positive outlook is attributed to Tim Cook, Apple’s CEO, who leads with a focus on rigorous discipline and innovation while prioritizing exercise. His compensation reached $75 million last year, signifying the immense value being created under his leadership.

**Meta**

**EXPERT VERDICT: BUY**

Mark Zuckerberg, a 19-year-old Harvard freshman, created Facebook in 2004 with no idea that it would evolve into a staggering $1.7 trillion company. Following a rebranding to Meta in 2021, the firm also owns Instagram and WhatsApp.

The focal point moving forward is AI, with Zuckerberg planning to invest billions to capitalize on this growth area. Analyst Aarin Chiekrie from Hargreaves Lansdown believes Meta is well-positioned to harness AI-related innovations and maintain its leadership in advertising and social networking.

Over the past year, Meta’s stock surged by 52%, reaching $715, an impressive ~1,770% increase since going public in 2011. Despite external competition, analysts still label the stock as a ‘buy’ with a target price averaging around $727.

**Microsoft**

**EXPERT VERDICT: BUY**

Founded in 1975 by Harvard dropout Bill Gates and a few partners, Microsoft has grown into a tech titan worth over $3 trillion today. The company’s portfolio ranges from the Windows operating system to the Microsoft Office suite, and it has a significant presence in cloud computing and AI.

Currently mayor under the leadership of Satya Nadella, who espouses a culture of gratitude and ambition, Microsoft faces intense competition from the likes of Chinese counterpart DeepSeek. Despite recent struggles, particularly with share performance having lagged behind its competitors, analysts retain their confidence. Currently priced at $410, the average target price is $507, with one optimistic analyst suggesting potential highs of $650.

**Nvidia**

**EXPERT VERDICT: BUY**

In just three decades, Nvidia has transitioned from a niche 3D graphics company to a $2.9 trillion powerhouse dominating the generative AI chip sector. CEO Jensen Huang bets that the remaining Magnificent Seven will continue their substantial investments in innovation.

Though Nvidia’s shares slipped by 6% this year, they’re still remarkably valued at 250 times their worth from a decade ago. Analysts firmly support Huang, with an average target price of $174.

**Tesla**

**EXPERT VERDICT: HOLD**

While Tesla is technically a car manufacturer, its true prowess – especially as part of the Magnificent Seven – lies in the cutting-edge software behind its self-driving technology. Led by CEO Elon Musk since 2008, who’s also dubbed “the world’s richest man,” Tesla’s influence is undeniable.

Despite recent sales, profit, and margin shortfalls, investor faith remains firm, as evidenced by the share price soaring 89% in the last six months. Musk’s forward-thinking outlook, involving humanoid robotics and AI integration for self-driving technology, has enticed investors, even amidst concerns about performance disconnects.

This disconnect, compounded by the impacts of shifting political landscapes, has prompted analysts to rate Tesla shares as a ‘hold.’ However, criticism looms, suggesting that the company’s operational metrics need closer alignment with stock performance.

Investors can take solace in the fact that Tesla’s share price has skyrocketed 24-fold since 2014, yet there are apprehensions about future stability amidst a rapidly changing landscape.